Apple Cash and Apple Pay are Apple’s digital payment services. See how the Apple Cash digital card compares to the Apple Pay digital service.

Apple Cash, a digital card, and Apple Pay, a digital service, come from Apple and are designed to make it quicker to pay and send money to friends and family. Both are available in your Apple Wallet and you can choose to set up one or both, depending on what you want to do.

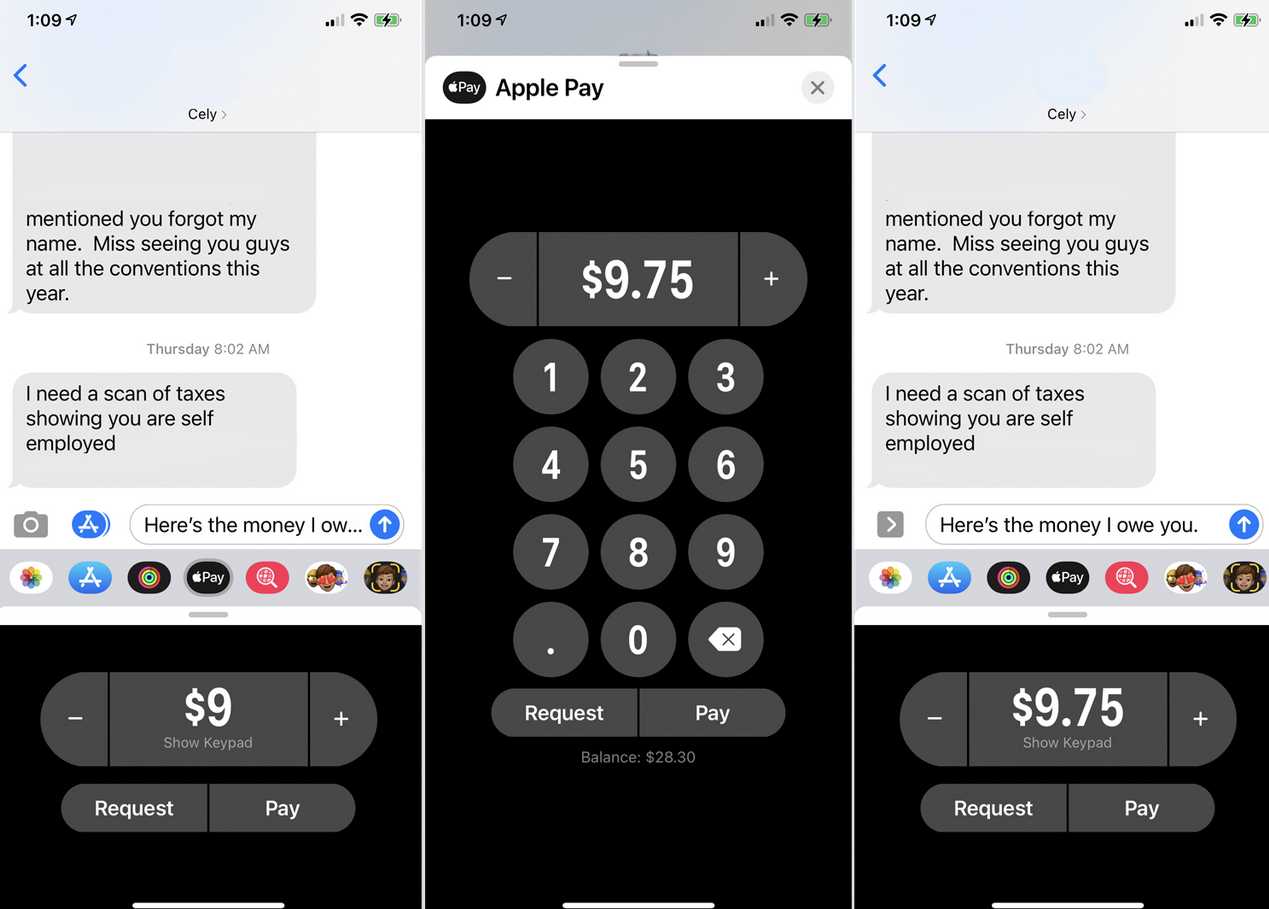

Both Apple Cash and Apple Pay are integrated into the Messages app. You can send and receive money just like you would with a text message, with no additional downloads required beyond the operating system. Apple Cash and Apple Pay are only available in the US.

Here’s what you need to know about how Apple Pay and Apple Cash work, their similarities and differences, and how they compare to Venmo and PayPal.

How does Apple Cash work?

Apple Cash is a digital card used to send and receive money from others in the Messages app or to fund other Apple Pay transactions. You can load your Apple Cash card (also called Apple Cash balance) with money from a debit or prepaid card.

With Apple Cash, you can:

- Send and receive money within the Messages app using Apple Pay.

- Fund payments through Apple Pay for in-app, online, and retail store purchases (anywhere Apple Pay is accepted).

- Receive cash back (called Daily Cash) from your Apple Credit Card, if you have one.

- Transfer your Apple Cash balance to your bank account.

How does Apple Pay work?

Apple Pay works by allowing users to make payments online, in apps, and in stores (basically, anywhere contactless payments are accepted) from their mobile device (as well as other Apple devices). You can use Apple Pay with a linked credit, debit, or prepaid card or with your Apple Cash balance. These payments must be approved with a passcode, Touch ID, Face ID, or by double-clicking the side button on the Apple Watch.

You can also send money within the Messages app with Apple Pay, funded with your Apple Cash balance.

Apple Cash vs. Apple Pay: What’s the difference?

Apple Cash and Apple Pay are similar in some ways. Both Apple Cash and Apple Pay:

- They are built into Apple devices (you will find them in your Apple Wallet).

- It can be used to make payments using your devices.

- It can be financed with a debit card.

The two also work together:

- If you want to make a payment with your Apple Cash balance in a store, in an app, or online, you’ll choose Apple Cash as the payment option through Apple Pay.

- If you want to send money in the Messages app, tap the Apple Pay button and use your Apple Cash balance to fund the transaction.

But there are some differences between Apple Cash and Apple Pay. For starters, Apple Cash is a digital card while Apple Pay is a digital service.

The other differences are:

Financing :

- Apple Cash can be funded with a debit card, payments received through Messages, or Daily Cash (Apple’s term for cash back) using your Apple credit card, if applicable.

- Apple Pay can be used with a debit card, credit card, prepaid card, or Apple Cash.

Way to pay :

- Apple Cash can only be used as a payment method through Apple Pay.

- Apple Pay transactions can be made with cards such as credit, debit, and prepaid cards.

Transfer to a bank account:

- You can transfer your Apple Cash balance to a bank account.

- You can’t transfer from Apple Pay to a bank account.

Can you get cash back with Apple Pay?

Yes, you can get cash back with Apple Pay, but indirectly. Users who have the Apple credit card automatically earn a percentage of their purchases as Daily Cash.

So if you use your Apple Card to make purchases with Apple Pay, you can get cash back with Apple Pay. You can choose to have your cash back deposited into your Apple Cash account or savings, if you connect your account with your Apple Card.

How to send (and receive) money with Apple Pay and Apple Cash

You can send money in the Messages app with both services, but you can only receive money in your Apple Cash account. You can send money yourself or use Apple’s virtual assistant Siri, which involves making a voice command like “Send $15 to Susan for lunch.”

When you receive money, it goes to your Apple Cash account. You can then spend the money or transfer it to a debit card or bank account, which can take up to three days.

For balances over $1, Apple Cash has a minimum transfer requirement of $1 when transferring money to a bank account. But if your balance is less than $1, you can transfer the entire balance.

Please note that the minimum deposit to your Apple Cash account from your debit or prepaid card is $10.

Apple Cash and Apple Pay details at a glance

| Cost of use | There is no fee to send, receive, or request money using Apple Cash with standard delivery times. However, if you select “instant transfer” when transferring money from Apple Cash to your bank account or debit card, there is a 1.5% fee subject to a minimum of $0.25 and a maximum of $15. |

| Financing options | Apple Cash: Eligible US prepaid or debit cards. Apple Pay: Eligible US credit, debit, or prepaid cards and Apple Cash. |

| Speed to charge a bank account with Apple Cash | Within 30 minutes with instant transfer if you use an eligible debit card. 1-3 business days to use a bank transfer. |

| What do you need | Apple device with the latest operating system. Two-factor authentication configured for Apple ID. Money in your Apple Cash account or on an eligible debit, credit, or prepaid card that’s linked to mobile Apple Wallet. |

Apple Cash and Apple Pay vs. PayPal and Venmo

Available platforms: Apple Pay and Apple Cash are available only on iOS, while competitors Venmo and PayPal are available on Android and iOS devices.

Costs to send money: It’s free to send money using a linked debit card or in-app balance with Apple Cash and Venmo. With Venmo, you can also use credit cards, but it costs 3% of the transfer amount. With PayPal, sending money with your in-app balance is free, but with a debit or credit card, it costs 2.9% of the total amount plus 30 cents.

Transfer Speed: With Venmo, PayPal, and Apple Cash, you receive money as an in-app balance, which you can then transfer to a bank account. This transfer can take up to three days with Venmo and Apple Cash, and up to a few days with PayPal.

Apple Cash, Venmo, and PayPal also have an instant transfer option, delivering funds in minutes. The transaction fee, subject to certain minimums and maximums, is 1.5% of the amount transferred for Apple Cash, but is higher for PayPal and Venmo at 1.75% of the amount transferred.

FDIC Insurance: Apple Cash transfers are serviced by a bank. When you sign up for your Apple Cash account, your money is federally insured up to $250,000, just like it would be in a traditional bank account. Balances on PayPal and the Venmo app are not insured by the Federal Deposit Insurance Corp. unless they are from direct deposits, such as paychecks or government benefits.

Transfer limits: Apple Cash lets you send up to $10,000 to another recipient per transaction and transfer up to $20,000 per week to your debit card or bank account. With Venmo, you can send up to $299.99 to others per week without verifying your identity; the limit is $999.99 per transfer and $19,999 per week for wire transfers if you have verified your identity. PayPal limits individual transactions to $60,000 and, in some cases, $10,000 per transfer; instant transfers to debit cards are capped at $5,000 per transfer per week; Instant transfers to bank accounts are limited to $25,000 per transfer.

Make payments: You can use Apple Pay (and Apple Cash through Apple Pay) in stores, apps, and websites. In addition, you can request the company’s credit card, the Apple Card, which also integrates with other digital applications. PayPal and Venmo can also be used to make payments online, in apps, and in stores, and each also offers a credit card.